Blog from RVW WealthCare Ltd

RVW WealthCare Principles of Investment Success

14th December 2017

Here at RVW WealthCare we believe that investment success is best achieved when you focus on what you can control.

It can be very easy to fall into the trap of focusing on the daily commentary regarding the financial markets, the news regarding the global economy and reading the latest “expert comments” on the flavour of the month investment.

Budget Speech - Nothing much to shout about

28th November 2017

At last a Budget speech with nothing much to shout about!

Every year as budget day approaches rumours abound pre changes that will be announced by the chancellor when he stands at the dispatch box in the House of Commons. This year there was the perennial chit chat about how pensions this and pensions that would be changed.

Fellowship Institute of Banking and Finance

27th February 2017

We are pleased to announce that on the 22nd February Adam was elected to Fellowship of the London Institute of Banking and Finance.

Fellowship of the Institute is only awarded to members that have successfully undertaken higher level professional qualifications, can demonstrate significant industry experience and have contributed to education/professionalism within the financial sector.

Adam's Financial Planning Degree MSc!

20th February 2017

As some of you will know Adam has been studying for the Manchester Metropolitan University's Master's degree in Financial Planning and Business Management over the last 12 months and on Friday 17th February, he was awarded a pass with Merit.

What is lifetime financial planning?

21st January 2017

You may have read or heard about lifetime financial planning in some of the recent financial papers, but what does it actually mean?

Well here at RVW WealthCare the term lifetime financial planning means having an understanding of all the aspects of your current situation and then projecting your financial position into the future.

Brexit to affect European holiday homes?

22nd August 2016

If and when Brussels IV no longer helps UK overseas property owners in Europe the consequences could be serious. Wills will need revisiting!

Mortgages for Self Employed

12th July 2016

When trying to get a mortgage agreed self employed people have a few more hoops to jump through than the employed. Someone that is self employed is typically a 'sole trader', but it is important to note that a Limited Company Director (with a significant shareholding, typically 20% or more) is also treated as self employed for mortgage underwriting purposes. Limited Company Directors are officially employed in the eyes of HMRC, however their earnings are usually influenced by fluctuations in company performance, in the same way a sole trader's income would be.

Financial Planning Week June 6th 2016

24th May 2016

RVW WealthCare Ltd is delighted to support Financial Planning Week 2016.

New State Pension is born

7th April 2016

April 6th 2016 saw brand new retirees receiving their state pension under the new flat rate system. The new pension regime is designed to offer simplicity and clear up the mess that had resulted from tinkering by governments of various persuasions over many years.

Trustee Duties

28th February 2016

Trustees stand in a rather unique position, they are in effect, the owners of other people's assets and thus the law places a number of duties and responsibilities on them.

Help to buy ISA

25th January 2016

Aimed at the first time buyer market, the help to buy ISA offers a tax efficient method to save towards the cost of purchasing a property with an added bonus of 25% from the UK government. Currently investors have until 30th November 2019 to take advantage of the scheme and must ensure any bonuses due are claimed prior to the 1st December 2030.

Adviser Winter Newsletter

4th Jan 2016

Adviser Winter 2016

In this issue we look at issues that could effect your retirement. Including raising awareness of credit cuts to pensioners who go abroad for over a month and additional taxation if any unauthorised payments are made.

“Pensions and Retirement”

Dilemma of Care Costs

22nd December 2015

Anyone who has been even just a little prudent and put something aside for retirement will likely breach the care self-funding figure of £23,250 and therefore be responsible for meeting care costs themselves.

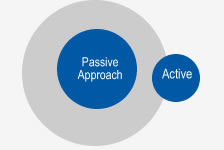

Core Satellite Investing

2nd November 2015

In this article we focus on Core Satellite investing, looking at how it's made up, investment strategies and the implememtation of a core satellite portfolio.

Care Costs

14th October 2015

We focus on Care Fees funding and government reforms

Summer Budget 2015

13th July 2015

Looking at the key points from George Osborne's Summer Budget on July 8th 2015

Care Funding - The small print!

3rd July 2015

Everything is going to be ok because the government are capping care costs! But beware the small-print.

Pensions have become exciting!

9th June 2015

“Pension plans have probably become the most tax efficient savings vehicle, a great tool for the creation, enjoyment and retention of family wealth.”

Pension vs NISA

3rd June 2015

- Anyone of pension age (55) will have complete freedom to take as much (or as little) from their personal pensions as they choose.

- The annual amount that can be saved in an ISA has risen to £15,000.